Pensionable Earnings 2025. In 2025, the second earnings ceiling, known as the year’s additional maximum pensionable earnings, or yampe, will be introduced. This new limit, known as the year’s.

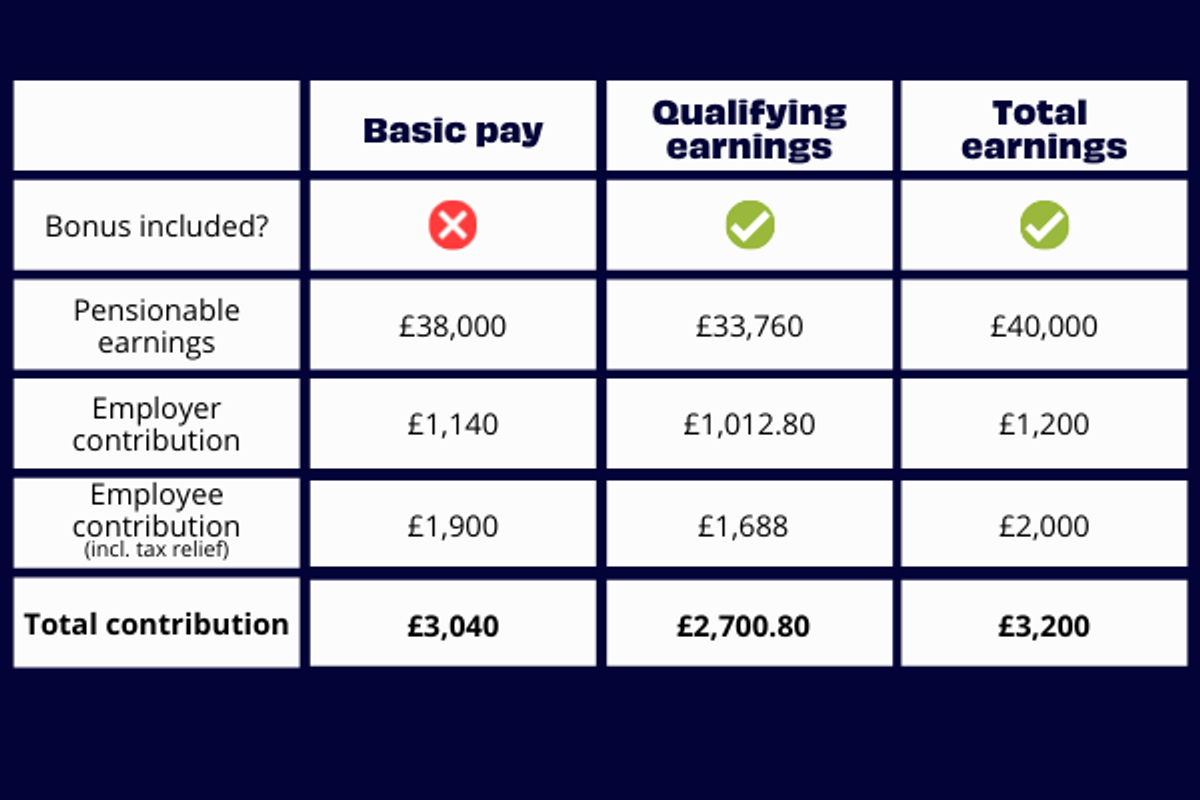

So the first task of an employer (or their accountant) is to work out the employee’s pensionable earnings. Cpp maximum pensionable earnings for 2025.

Effective january 1, 2025, as part of the cpp enhancement, cra is implementing a second earnings ceiling at $73,200, known as the year’s additional maximum pensionable earnings (yampe).

The maximum pensionable earnings under the canada pension plan (cpp) will be $68,500—up from $66,600 in 2025.

CPP Maximum Pensionable Earnings Increased to 68,500 in Year 2025 Everything You Need to Know, Here you can find the earnings thresholds for the current tax year, broken down by pay frequency, plus the historic earnings thresholds starting from when the law was. This new limit, known as the year’s.

What are pensionable earnings? Penfold, In 2025, the year’s additional maximum pensionable earning (yampe) is 7% higher than the ympe, a total of $73,200. It is formally known as the year’s maximum pensionable earnings, or ympe.

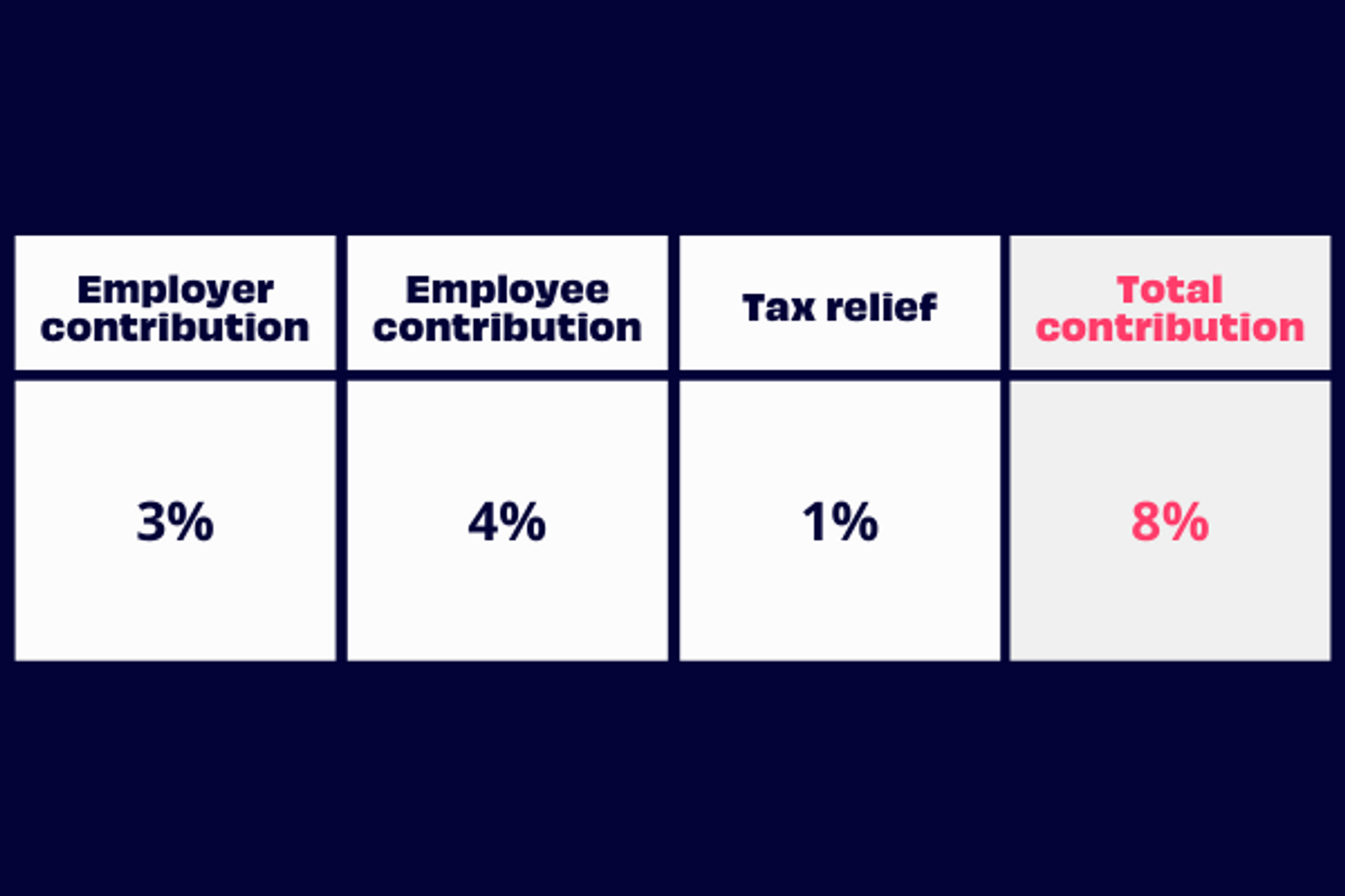

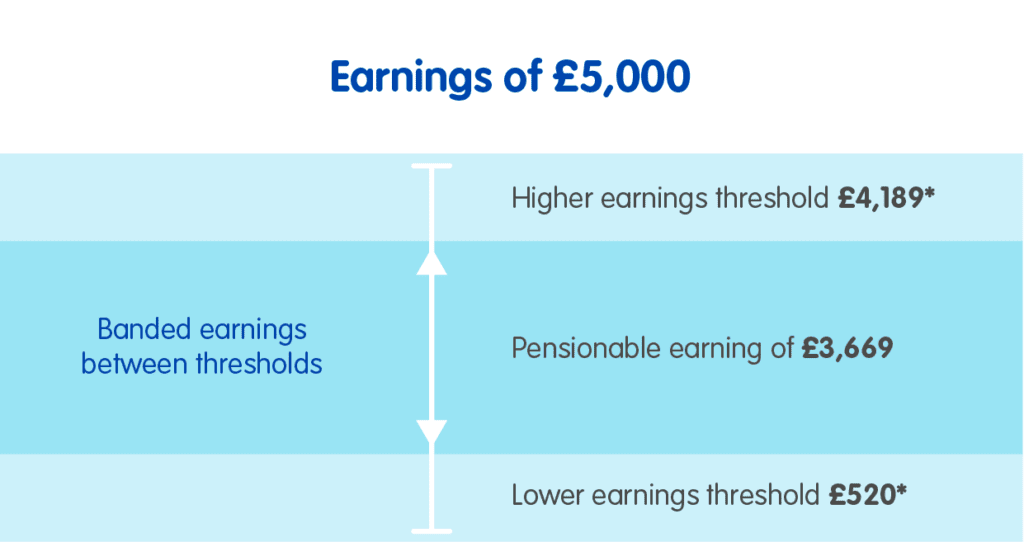

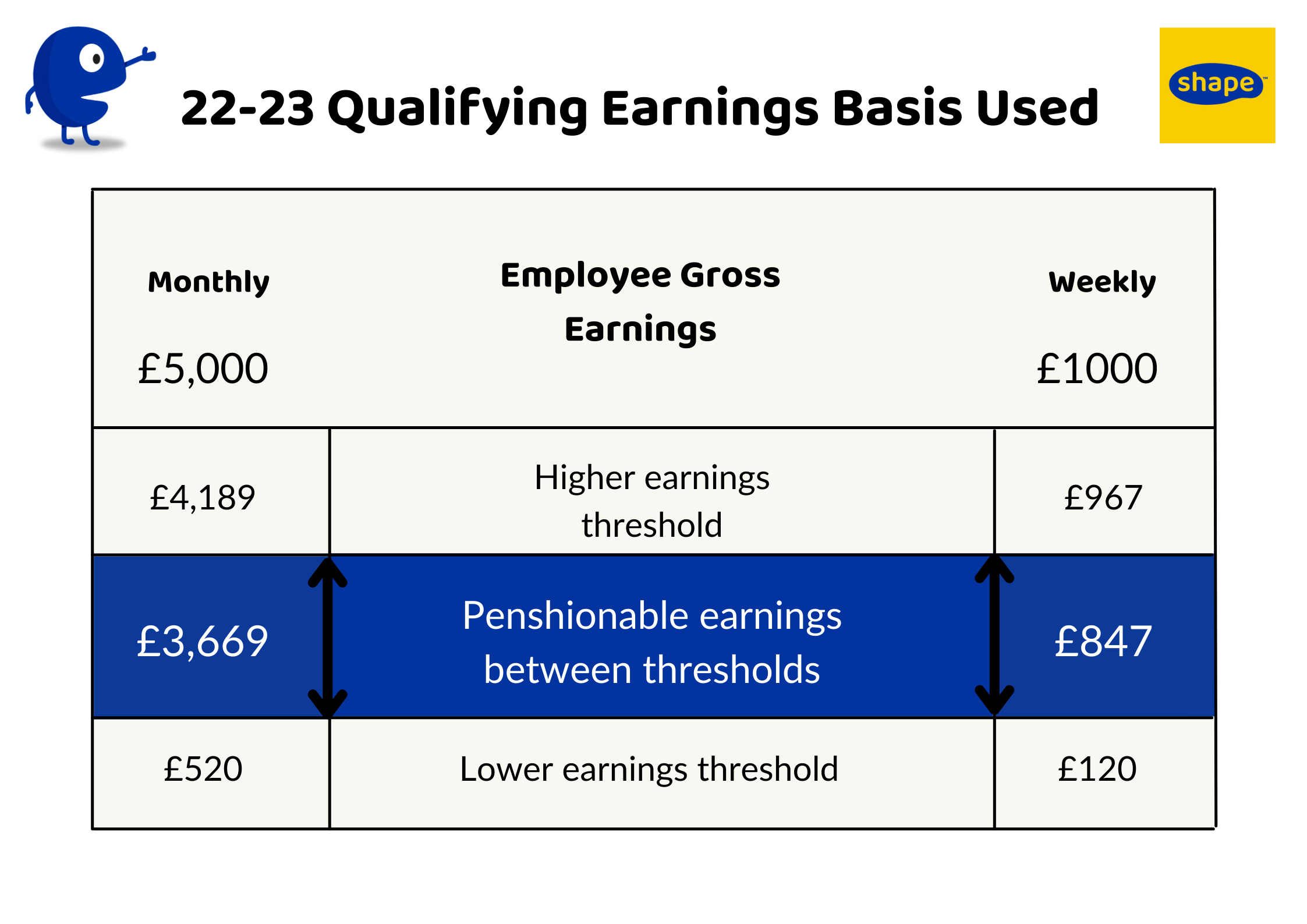

NSSA Pension & Other Benefits Scheme (POBS) contributions insurable earnings ceiling rates, Qualifying earnings is a band of earnings you can use to calculate contributions and is used by most employers. Effective january 1, 2025, as part of the cpp enhancement, cra is implementing a second earnings ceiling at $73,200, known as the year’s additional maximum pensionable earnings (yampe).

Confirmed CPP Maximum Pensionable Earnings to Reach 68,500 in 2025 SarkariResult SarkariResult, The first earnings ceiling, or ympe, will be $68,500 in 2025. The maximum pensionable earnings under the canada pension plan for 2025 will be $68,500, up from $66,600 in 2025, according to the canada revenue.

Year’s Maximum Pensionable Earnings 2025 Canada YMPE Payment Date & Eligibility Check, This will allow the cpp to protect a higher portion of your earnings. The maximum pensionable earnings under the canada pension plan (cpp) will be $68,500—up from $66,600 in 2025.

What are pensionable earnings? Penfold, Second additional cpp contribution (cpp2) rates and maximums. How much you pay and what counts as earnings depend on the.

Changes in NHS pension contributions Are you a winner or loser? Legal & Medical Investments, Starting in 2025, a second, higher earnings limit will be introduced. Additional employee and employer contribution rates for 2025 will be 4.00%, on earnings above the ympe, up to the yampe.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

What are pensionable earnings?, Qualifying earnings is a band of earnings you can use to calculate contributions and is used by most employers. This will allow the cpp to protect a higher portion of your earnings.

Paying Social Security Taxes on Earnings After Full Retirement Age, This will allow for the cpp to protect a. The first earnings ceiling, or ympe, will be $68,500 in 2025.

Pensionable earnings Shape Payroll, The maximum pensionable earnings, or first earnings ceiling (ympe), in 2025 will be $68,500, up from $66,600 in. Qualifying earnings is a band of earnings you can use to calculate contributions and is used by most employers.

Here you can find the earnings thresholds for the current tax year, broken down by pay frequency, plus the historic earnings thresholds starting from when the law was.